Don’t Let This Happen To You

Picture this… it’s a quiet morning in your office. You walk into the break room to put your food in the shared-use community fridge. As you enter, there’s a general buzz of morning banter in the break room.

But then, nightmare of nightmares: the room gets quiet and everyone’s attention goes to you.

Has this ever happened to you? Coworkers putting your financial hygiene on blast? Well, step your p**** up and you could become a millionaire in 24 years using the same money you were just pissing away!

I know what you’re thinking…

You got it twisted, Homo Money. I don’t spend that much money!

Just like the many, maaaaany other kinds of hygiene that gay men tend to obsess about, financial hygiene is one area that could use a little “sniff test” for all of us.

Financial Hygiene in my own life

The scenario above is a tongue-in-cheek example. Personal finances are personal. So what I value is not the same thing the next person values. However, the main point of financial hygiene is to do a periodic check-up with your monthly spending to be sure the places where the money is going out… is to the places you value.

Not to worry if you’ve never checked your financial hygiene before. The truth is, I get sloppy with my own financial hygiene, too. Progress doesn’t follow a straight line. Finances, like life, is lumpy.

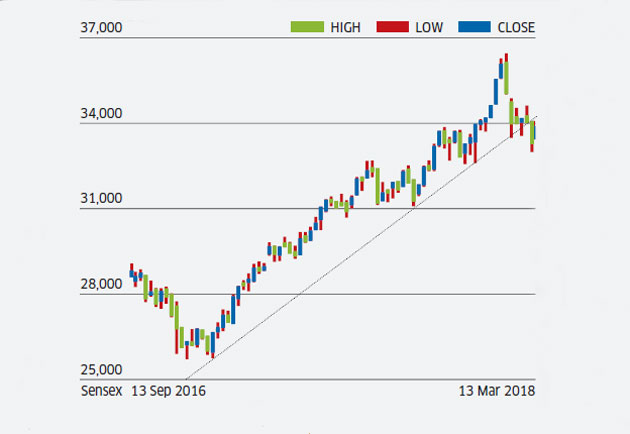

I consider financial progress to be more like a high-performing stock ticker. It has highs and lows from day to day, but overall, it’s trending up.

What I’m about to share with you is the process I go through every 3-6 months to clean up the spending I’m not even using, discover a little “found money,” and put those busted bills to better use. Girl, prepare to be gagged!

Does the following scenario sound like you?

If you are the type of queen to buy all of your coffees from Starbucks, let me share a quick example with you of how easy it can be to let our financial hygiene go unattended.

Last week, a friend of mine was telling me about how much he loves the $10 premade meals he was buying from a local health food grocery store. This price was a steal compared to meal prep services, which would normally cost $12-15 per meal after adding in tax and shipping. So, he would buy out everything they had in stock so he could have two pre-made meals a day while at work for $10 each.

Compared to the cost of meal prep services, he was saving money, right? But, with some quick math, the calculator in my Homo Money brain was on overdrive. I thought to myself, “That’s $20/day, which is $100/week. Overall, that’s $400/month just for his workday lunches!”

I go out to eat a lot myself, so this was a good awareness for me, because I have probably spent MUCH more than that on my own workplace meals and not even been aware of it.

But $20/day ain’t so bad for breakfast and lunch! I mean, it’s two full meals with healthy ingredients!

Let’s put this into context

Nutrition-wise, you’d probably want to get some more fresh fruits and veggies in your system instead of having so much of your fuel being reheated in a microwave, but we won’t go there. Financially, consider this: $400/month is a mortgage payment in many parts of the U.S., including the town where I’m from.

Should I keep a budget?

According to a lot of the people interviewed on the podcast, Millionaires Unveiled, they actually do not keep a budget. Personally, I don’t either. But I do recognize that what counts gets counted. So, I like to use a process inspired by Zero-Based Budgeting (ZBB) in which every dollar is accounted for.

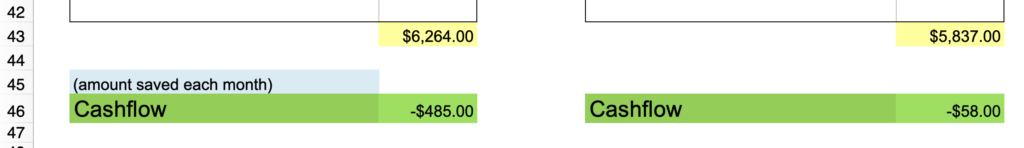

After paying myself first with money going into all the most important savings accounts, I am free to spend freely with what I have left. However, I like to create a cashflow spreadsheet to give myself a general goal to aim for.

Here’s my process in a nutshell:

-

-

After linking my credit and debit cards to Mint.com or Personal Capital, I have real-world data to pull from. I like to look at a 6-month history for each category to get an average of what my monthly expenses are. (Note: you will probably need to review these charges to be sure the budgeting app assigned everything to the correct category.)

-

Input your numbers into a spreadsheet and sort your categories from highest to lowest. This helps me focus on what items need the most attention.

-

Copy your spreadsheet’s cell for your “current state” and paste a copy to the right of what will become your new “future state.”

-

Go through each of the line items and get creative! Are there certain things you’re spending money on that you’re not enjoying? Maybe an unused monthly subscription that has kept getting auto-renewed for too long? Is there something that you thought you would be using but never did? Are you able to negotiate some part-time or full-time telework to reduce your gas spending? You could also start calling around to your utility bills to negotiate a lower rate, or use a service like AskTrim to do the heavy lifting for you.

-

Fill out your info below to download the same Excel spreadsheet I walk you through in my video tutorial above. This will also add you to my VIP list, so you’ll be the first to know anytime I have a new HOMO-licious blog post hot off the presses.

In case you’re not ready for all that…

If a full-on Excel-driven financial makeover sounds like too much for you, you could start with something smaller. Use the round-up feature in an app like Acorns to round up to the nearest dollar for every purchase and automatically invest it for you.

Before long, you’ll notice that you don’t even miss the extra change and, if you’re like me, you’ll want to eventually start adding an extra $5/day or more to your Acorns account so you projected future earnings are even higher.

Come on, Homo Money! Give me a break! How will saving $20/month on my haircuts make a difference in my financial hygiene?

Thanks for that question, Nellie!

That’s actually what I love about the auto-sum formula that’s built into the bottom cell of each column. As you trim your expenses in each category, the sum total of all your cost-cutting will automatically be calculated by my spreadsheet template.

As you work through your categories, fill in some strategic goal amounts for your future state and you’ll find a tiny little saving $5 savings here and a $10 savings there. Before you know it, it really adds up!

And now comes the fun part!

How will you reallocate your newfound savings? After all, your financial hygiene is squeaky clean, so you might as well put it to good use and werk it, girl!

For my own situation, I’m already maxing out my retirement accounts, so every little bit of wasted spending I can scrub will go toward the extra $1,800/month my new condo is costing me with my category of “Housing.” But for you, the found money you pull together from a little scrubbing and Financial Hygiene can be put toward whatever you’d like.

And in the spirit of zero-based budgeting, that new purpose you’ve given to your money may mean adding a new category to your spreadsheet, like “Vacay.” 🙂

Some common areas to clean up with financial hygiene

Still not sure if you’d have much luck by going through my financial hygiene exercise? Here’s a few categories where you could have some stanky spending just waiting to “get turnt” as some found money:

Switching to a pre-owned and/or a more fuel-efficient car. Consider adopting a little Hustle and buying a used car with cash to drive for the next 5-10 years. For most Americans, cutting out a constant car payment would immediately save them $563 every month (according to the average payments reported by Lending Tree.)

Not going out to lunch every day for $17/day, which, after doing that Monday through Friday for a month, will add up to $340/month.

Teleworking to slash your gas budget. According to Value Penguin, the average in the U.S. to tank up their car is $250/month. I drive a car that’s 15 years old and commute 30 minutes each way to work. According to my averages from the last six months, my gas bill is around $332 every month. After getting approved to telework part-time, I plan on cutting my gas bill in half ($166) and cutting out the toll road as much as possible ($80 savings). That already puts me $246 closer to my $1,800 savings goal with just that one spending category alone.

What to do after your finances are thorough “scrubbed”

Where you choose to direct your newfound money is your choice, hence the saying “personal finance.” Let’s say you’ve followed my exercise and now have an extra $500 every month. You could direct that toward something that excites you, like a vacation fund or real estate down payment fund. Or maybe just invest the $500 every month into a Roth IRA.

Leave me a comment to share where you’ve been able to find the best places to save money and let’s celebrate the grand total of your own newly discovered “found money.”

But don’t let too much time pass before you clean up your “situation” you got brewing in those stanky credit card statements. You might want to set a calendar reminder to do another financial hygiene check in another 3-6 months.

Scrub-a-dub-dub, queens!

0 Comments