Whether you call today Columbus Day or Indigenous People’s Day, we’re gonna honor both in the context of multiple streams of income. We’ll be talking about how to chart a course for new lands of income (Columbus, girl!) while also holding on to what you already got (Indigenous Peoples, y’all!).

There’s an often-quoted stat in the personal finance space that nearly 40% of U.S. households would not be able to cover a $400 emergency with the money they have liquid (a.k.a. able to be accessed immediately and not borrowed from Miss Thang down the hall).

Nearly half of us can’t even come up with $400!? We’re screwed!

Despite living in the Land of Opportunity, it sounds bleak for those of us trying to digging our way out.

But it doesn’t have to be.

Rather than mope around like a busted queen complaining about high tax rates, being passed over for a raise, or the rising cost of living, let’s take control of our financial future. Let’s tap into our natural LGBT resilience and, as Mother Ru would say, STEP OUR P*SSY UP!

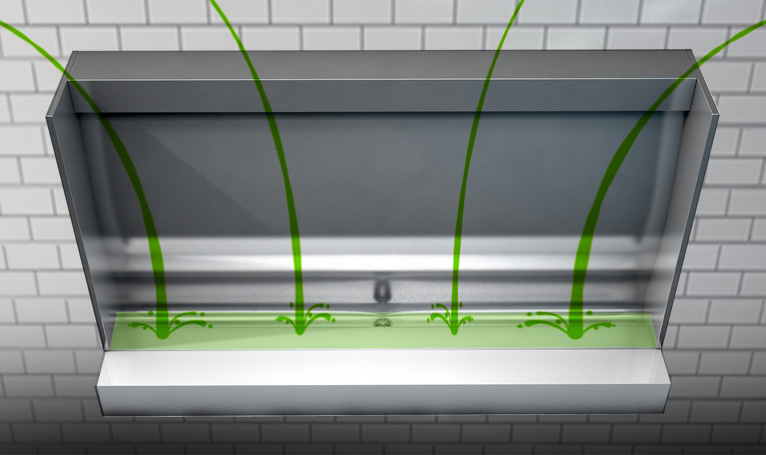

The Multiple Streams I’ve Used To Fill My Income Buckets

In addition to my W2 income as a full-time government employee, I have a couple side hustles that I’ve kept on the back burner in case a new request pops up:

- My B2B (business-to-business) video production company for small businesses. Without advertising it, this side business typically brings in around 1-2 projects a year at $2,500 per project. That’s been perfect for me, since that was the most time I could spare anyway while working a FT job.

- My B2C (business-to-consumer) video production company for families. This is a newer venture that brings in about one project a year, also around $2,500 per client.

Daaaaaang, Homo Money! How You Juggle All Those Streams?

For all my single ladies out there, I would relate side hustles to dating.

You never know when you’ll make a connection, so for me, it’s helpful to have multiple leads being developed at the same time.

In the end, you don’t need to worry about working all your side hustles at once, but instead, treat them more like income whack-a-mole and focus your attention on them one-at-a-time when an opportunity presents itself.

My Additional Streams of Income

- A how-to book I self-published on Amazon, which brings in a trickle of royalties every month. Financially, no big whoop. This was a passion project I wanted to put out into the world and was never about the money. But I figured I’d mention it, even though it’s just a teeny tiny little baby stream.

- A cash flowing condo listed on Airbnb. Earlier this year, I had the good fortune of paying off the mortgage on my Airbnb rental. That was made possible by the Hustle of taking on a 10-month work assignment in DC that allowed me to sock away money like crazy. Now, without the burden of a mortgage, this asset brings in cash flow of around $900/month. And it would be even more if I had the time flexibility to manage it myself, but instead, I pay my co-host 15% of the booking fee and he handles all the correspondence with guests and keeps the entire cleaning fee after turning it over after each guest checks out. If someone wanted to do the co-hosting themselves for their own (or someone else’s) Airbnb listing, a similar property will bring in another $1,000/month stream of income. If this option appeals to you, check out my article on maximizing your short-term rental income with Airbnb.

- Thanks to my broke-ass neck and back, I am grateful to have VA Disability Compensation of $1,670/month. That benefit kicked in about 4 years ago and has been a game changer for me. I realize this stream of income will only apply to disabled vets, but the lesson here is this: know what benefits are available to you and look into your eligibility. I’ll be writing more about how vets can maximize their VA benefits later this year in a Veteran’s Day post.

Where I Like to Direct My Streams

To ensure I don’t mindlessly piss everything away at the end of the month, I like to set up pre-authorized withdrawals into all the usual buckets: $1,625/month into a 401(k) and $300/month into a Health Savings Account (HSA). That leaves me about $1,700 every two weeks in take-home pay.

And to take the pay-yourself-first concept even step further, I have $500/month going into a Roth IRA and invested in VTSAX. Here’s the steps I took for putting this investment on autopilot with Vanguard.

Within my checking account, I have a sub-account called “Vacation Fund” where $200 is automatically deposited from every paycheck. As this balance grows over time, it give me a budget for my trips to Palm Springs, gay cruises, etc. It also reverses the normal “buyer’s remorse” of paying for a trip after the fact, and instead, gets me excited for the trips I have coming up as I see the vacay fund growing big enough to cover my next trip. If you want to step up your financial jargon, I’ve heard this system of save-first-and-buy-it-in-cash referred to as a “sinking fund.”

And lastly, I also put $10/day into Acorns for some forced savings. This has been a good way to hide money from myself as play money or as an emergency slush fund. I list this app on my Resources page because I think it’s an excellent first step for someone needing to create some health financial habits.

This makes every paycheck a lot smaller, but ensures I pay myself first and set some limits on how much I’m left with to “piss away” on frivolous stuff and junk.

Have Fun with Your Side Hustles

Ready to kick your income up a notch but not sure where to start?

You have the usual options from the gig economy like Uber, Lyft, DoorDash… but I’ve heard those can be hard to make much more than minimum wage unless you’re combining it with your existing routine. For example, getting paid to provide rides to people who are going in the same direction as your existing commute that you would’ve been taking anyway.

To think outside the box, I loved all the creative ideas in this article on 50 Ways To Make Money That You’ve Never Heard Of. Here’s a few of my favorites:

- Get paid to watch short video clips online (#3)

- Become a “secret hopper” for local breweries (#12)

- Be someone’s rent-a-friend (#27)

- Teach English to kids online (#35)

- Get paid to watch movies in the theatre! (#38)

- Sell your smartphone photos within a stock-image app (#43)

- Housesit someone else’s swanky pad (#47)

And Now For the Fun Part… Taxes!!!

Okay, maybe not the most fun. Keep in mind, I’m not a CPA or offering tax advice. But I will pass along a couple tidbits that I’ve been told over the years so you can be aware of them.

-

Deduct when you can. According to the IRS, “You generally cannot deduct or capitalize a business expense until economic performance occurs.” My solution: create side hustles for things I would’ve spent money on anyway. For example, for all the streaming TV services I would’ve wanted for myself, I buy them for my rental property! This gives me access to all the goodies while also keeping my guests happy with 5-star reviews.

-

Don’t Cross the Streams. To make things easier for yourself when tax season rolls around, keep all your business expenses in a separate checking account and/or credit card. That way, you don’t have to sort everything out at the end of the year. This is something I’d like to improve upon myself. For now, one thing my Airbnb co-host does is to send me Venmo request with detailed notes whenever he cleans the condo or buys supplies for it, and I make sure Venmo pays him from my checking sub-account that I set up for my rental property.

Okay Homo Money, I have my side hustles in place. I have pre-authorized distributions set up. But I’m pissing through what I have left too fast before my next paycheck drops. How do I create better spending habits to make what I have left last a little longer?

Good question! For the answer to that, stay tuned for my followup post next week, which will cover what I call “Financial Hygiene.”

That’s my story, but I’d love to hear from you. Do you have any additional streams of income you’d recommend others try? Or better yet, that you’d recommend we stay far, far away from? Share your pearls with us in the comments below.

Until next time, get those streams, queen!

0 Comments