There’s one particular line item I really hate in a cash flow tracker (a.k.a. budget): the “Miscellaneous” category! This is not a fun category to budget for. It’s not an exciting vacation or a new pair of shoes. Instead, it’s some random, unplanned punch to the gut that you wish had never happened.

So far in 2022, I’ve had three of those:

-

Caught COVID last month and I had to quarantine at home and miss my favorite gay holiday: San Diego Pride!

-

Within that same week, my car was stolen. The culprit was a squatter who had not paid rent for months. In his farewell act before being forced out, my 2006 Honda Element was chosen for his real-life version of grand theft auto. At 4am, he clipped the wires going to the horn so the alarm system wouldn’t sound off and stole my car from my assigned spot of the gated parking garage.

-

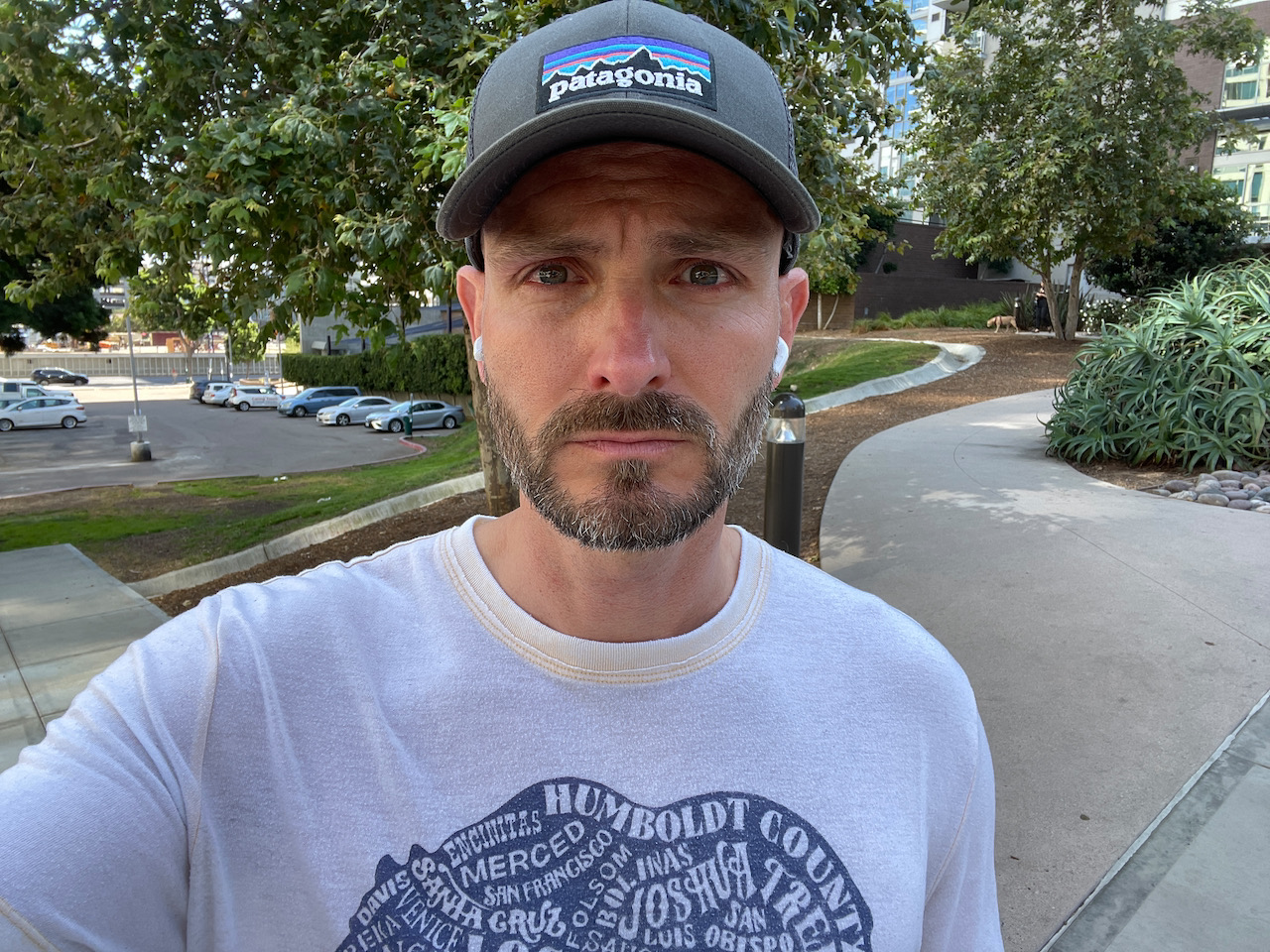

None of those setbacks impacted me more, though, than May 2022. That’s when I had to have my sweet Zoe put down. The photo above was taken after walking by her grass patch for the first time since our final walk together. After 16.5 years of hikes, beach trips, nap time, road trips, and birthdays, my modern dream home suddenly became quiet. I was no longer living independently as a single dog dad. Zoe was gone and now I was alone. It was just me.

My support system through it all

Thankfully, my best friend Dan was there when the in-home pet euthanasia service came to my condo to help Zoe out of her discomfort. She was the first dog that was mine and not my parents’ dog. That bond was unlike anything I’ve experienced with a pet. Because of his mutual love and time spent with Zoe, Dan shared in my grief, so it was a comfort that I didn’t have to go through the trauma alone.

After the vet drove off with Zoe’s remains, I remember sitting on the balcony of my condo, a stiff drink in hand. Dan was in the next room, helping take care of me by cleaning the hardwood floors of my living room where Zoe had an accident the night before.

I don’t know if it was depression or grief or something else, but all I could do was sit there and stare. Shell shock is the only way I can describe it.

If I were to look for meaning in how that curve ball has impacted me, I guess the lesson I learned is that we never really know how a major life event is going to affect us until it actually happens. Over the coming weeks, it was a daily battle for me to focus at work or do anything productive. The most mundane parts of my day felt like I was trudging uphill through mud. What I used to think were priorities, like the pressure I gave myself to post regularly to this blog every two weeks, fell by the wayside. Homework assignments, minor frustrations like emails and traffic, disagreements with people who came in and out of my life… it all seemed trivial now.

I like to think that in a final act of love, Zoe gave me this gift of perspective. “It’s time to slow down, dad.”

The rose among the thorns

My loss of Zoe has made me value certain things more:

- My time

- My health

- My family (namely, my mom, sister, and my chosen family here in San Diego, like Dan, Jeff & Charles, Jeff & Felipe, and my work wife, Kelly)

Is it all about the money?

I see a lot of people scoff at the idea of pursuing financial independence (FI). They wonder how someone could possibly fill their days if they were to retire early. They assume that we won’t find another job or passion that excites us. They also assume that someone on the path to FI is living in constant deprivation and unable to enjoy life.

The truth is, we in the FI community make a ton of progress because we just don’t care to keep up with the Joneses to buy something if it does not enhance our lives. Reflecting on your core values usually results in a realization that your life is a lot less expensive than you thought.

FI has never been about the money. It’s about the lifestyle you can have when you’ve created enough passive income to no longer be required to work a 9-to-5. At that point, your life is not dependent on a paycheck; you can benefit from the time freedom to focus on all the things you value most.

Additional takeaways

Some bonus nuggets my situation has made me think more about:

-

Optimize your life so you can carry on during hard times. When I started my blog, I was on a work assignment in DC during COVID. Because of so many things being closed and a limited social network, when I finished the workday, I had nothing but free time! Blogging and creating social media content was a creative outlet that I needed. But after returning to San Diego, enjoying time with friends, better weather, and businesses opening up again, time became a much more limited resource. Similarly, if you have things you need to do regularly, it could be helpful to plan out ways to do it as quickly and efficiently as possible BEFORE you get into a time crunch or suffer some type of tragedy that saps all your energy.

-

Planning to retire at Lean FIRE isn’t really planning. This is a point I made in my post about why Suze Orman hates the FIRE movement. That’s why my goal is not FIRE, but to instead, to aim for Fat FIRE (generating more passive income than I need for my monthly expenses by the time I’m eligible to retire from my government job at 55). Instead of assuming that your current lifestyle of $3,000/month in say, your 30s, will sustain you for the rest of your life, plan for the unexpected. Plan for a health catastrophe. Plan for the loss of an income stream. If you have a pension, plan for what you’ll do if it were poorly managed and went away. In short, plan for the possibility that the bare minimum in retirement income will not be enough to sustain you forever.

-

Estate planning. I once heard on a podcast episode of Rich & REGULAR that if your life is simple and doesn’t include side businesses, rental property, etc. you may be able to take care of your fabulous next of kin with a basic template from an online service like Trust and Will ($599 setup for an individual trust and then $39/year) or Legal Zoom ($399 setup for an individual trust and then $199/year, unless you choose to cancel the annual updates). Otherwise, you may want to invest a few thousand dollars to consider having a custom estate plan drafted for you by a local attorney to be sure all the details of your finances, family, and fur babies are accounted for.

-

Term life insurance. If you don’t have it and you have people in your life who depend on your income, get that thang, girl! It’s only like $20/month!

In an effort to focus more time away from the laptop, I’m going to end this here. As a promise to Zoe that I will slow down, I also make a promise to you that you won’t see a new blog post from me in two weeks. It’ll probably be more sporadic and released in a month or more.

If you like my content and want to stay in the loop, I’d encourage you to follow me on IG where I post most often and subscribe to my updates via email so you don’t miss my future blog posts.

To close out, I’d love to keep the conversation going. What curve balls has life thrown at you and how did you deal with them? Did you make any decisions or come up with any new systems to optimize your life moving forward? Was there a silver lining that came from your tragedy?

Beyond the support from Dan, I want to publicly say thank you for all the calls, texts, and visits from many other people in my life. Kelly, Dy, Jeff & Charles, my sister Ruth, my Mom, and even my ex-boyfriend… their check-ins made a world of difference. Thank you to Josh for giving me the dog angel bell, which makes me think of her tail wagging every time I her it ring and see the lower weight swinging back and forth. Thank you to my work wife, Kelly, who surprised me with the thoughtful photo and angel figurine above. And thank you to my mom, who mailed me the doggy stuffed animal that’s on my bed now as Zoe’s stand-in. ![]()

Thank you for sharing this with us, jeff.

I appreciate you saying that. It was cathartic to get this one out of my system. If it helps anyone out there, it’ll be worth it.

Awe Jeff, that was a lovely tribute to Zoe. Let’s talk soon. Call me.

Thank you. Sounds good.

You never know what’s around the corner… I think that’s what I am all about… My life… Most of the times I’m always excited what to find around the corner. I love the idea of exploration and discovery and excitement and wonder when you find new things that you did not even know where there.

But occasionally, catastrophe can be just around the corner too that you are definitely not ready for.

It can take many forms…

Seems like most of my life I have also had a wrench thrown in the works and you have to navigate that. You have to adapt and change. I know it’s cliché, but those are the things that do make us stronger. The things that are difficult are the things that make us grow. And knowing you, quite well, you are about self growth.

You and I are both lucky that we have best friends in each other. I think there are people out there though that may not have best friends, people that will not drop what they’re doing in a second to go help, or to get help if needed. That part can be a huge stress relief knowing someone is there for them.

Another huge stress relief is knowing when a wrench is thrown in the works and you have money needed for whatever it may be. I did not always have that in my life and can be devastating having to deal with things by yourself. And if you don’t have the money to help yourself, then what do you do…?

I have been really grateful that my money situation is much better thanks to your help. And I’m looking forward to it getting even better soon!

As far as how I’ve been dealing with things… The biggest thing in my life was also losing Zoe. That has been extremely hard and I am still not over it yet. If I think too much about her, I start crying still. I think for me, I have just been distracting myself with a lot of restaurant food, takeout and getting massages. Self pampering. Just giving myself more treats than normal. I feel like it is finally starting to slow down a little bit and I am not doing it as much. I am starting to cook at home again which I completely quit when we lost Zoe. Cooking was one of my joys and I just was not ready to bring that back after Zoe left.

It can be very tough and things take time to smooth over, but it is good to know that we have people that care about us and it is good to know that we can take care of things needed on our own also. Not having to rely on other people financially. When you can rely on yourself financially, it makes you feel good that you can do this … That you have planned for this and that you know that whatever happens you can overcome and get beyond…

Very true, Dan. I didn’t realize that Zoe’s passing was still affecting you so much. That shows how much she meant to you, which is very touching to know how much she was loved. Thank you for being there for me while you were grieving so much yourself.

What a great read this was! Thanks for being so open and sharing your feelings. You’re a great guy with a promising future! 💪🏻😘

Thanks Josh! I appreciate you taking the time to comment. Hopefully my story can help someone out there. I appreciate you!